Burleson car title loans provide a fast and accessible way to get emergency cash, focusing on your vehicle's value rather than credit score. The simple application process can be done online or in-person, but interest rates vary between lenders. These loans are suitable for debt consolidation or quick advances, appealing to those with varied credit histories. However, they come with shorter terms, higher rates, and repossession risks, so responsible borrowing is crucial.

In times of financial urgency, Burleson car title loans offer a swift solution. This form of secured lending allows you to access emergency cash using your vehicle’s title as collateral. If you’re facing unexpected expenses and need fast funding, this article guides you through the process. We’ll explore how to qualify, the application steps, and the advantages and drawbacks of Burleson car title loans, empowering you to make informed decisions in times of financial need.

- Understanding Burleson Car Title Loans: A Quick Cash Solution

- How to Qualify and Apply for Burleson Car Title Loans

- Benefits and Considerations of Using Car Title Loans in Burleson

Understanding Burleson Car Title Loans: A Quick Cash Solution

Burleson car title loans offer a quick and convenient solution for those in need of emergency cash. This type of loan is secured by your vehicle’s title, allowing lenders to provide funds based on the value of your car. The process is designed to be swift, with many companies offering an online application that can be completed in minutes. Once approved, you can receive your funds quickly, providing a reliable source of emergency financing.

Unlike traditional loans that require extensive documentation and credit checks, Burleson car title loans focus on the vehicle’s value rather than the borrower’s creditworthiness. This makes them accessible to a wider range of individuals, including those with less-than-perfect credit. Additionally, the online application process for Houston title loans simplifies the entire experience, enabling borrowers to apply from the comfort of their homes and receive vehicle valuation estimates before committing to a loan.

How to Qualify and Apply for Burleson Car Title Loans

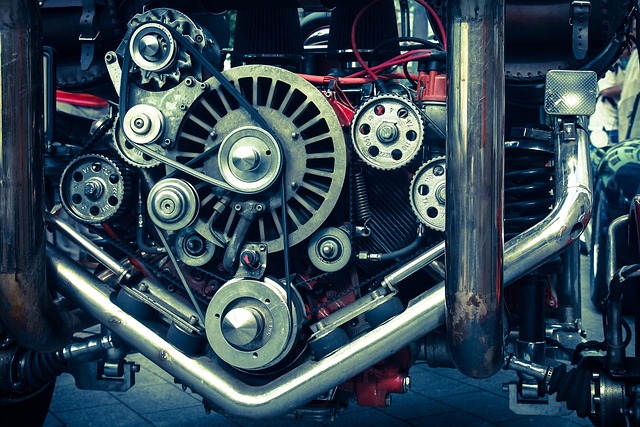

To qualify for Burleson car title loans, you’ll need to meet a few basic requirements. Lenders will typically verify your identity, income, and vehicle ownership. Providing proof of these elements is crucial when applying for this type of loan. You can expect to present government-issued ID, recent pay stubs, and the title (or lien-free certificate of ownership) for your vehicle. The process is designed to be straightforward, ensuring that eligible individuals can access emergency cash in a timely manner.

Applying for Burleson car title loans involves submitting an online application or visiting a local lender’s office. You’ll need to provide details about your vehicle, including its make, model, year, and current mileage. Lenders will then assess the value of your car to determine the loan amount offered. Keep in mind that interest rates can vary between lenders, and understanding the associated fees is essential for making an informed decision. This type of secured loan can be particularly useful for those seeking debt consolidation or a quick cash advance.

Benefits and Considerations of Using Car Title Loans in Burleson

In Burleson, accessing emergency cash through car title loans offers a quick and convenient solution for those in need. One significant advantage is the simplicity of the process; unlike traditional loan options that require extensive documentation and credit checks, car title loans primarily rely on your vehicle’s ownership and equity. This makes it accessible to a broader range of individuals, including those with less-than-perfect credit or no credit history.

When considering Burleson car title loans, it’s essential to weigh the benefits against potential drawbacks. While the interest rates are often competitive, the loan terms might be shorter, requiring timely repayment. Additionally, borrowers should be prepared for the possibility of losing their vehicle if they fail to meet the repayment obligations. However, responsible borrowing practices and a solid understanding of the terms can ensure a beneficial transaction, providing a safety net during unexpected financial emergencies while leveraging your vehicle equity.

Burleson car title loans offer a convenient and quick solution for emergency financial needs. By leveraging your vehicle’s equity, you can access cash without the lengthy waiting periods associated with traditional loans. Understanding the application process and benefits will empower residents of Burleson to make informed decisions when facing financial emergencies. Remember, while car title loans can be a useful tool, it’s essential to weigh the costs and consider alternative options to ensure the best financial outcome.